IRS 668-B 2003-2026 free printable template

Show details

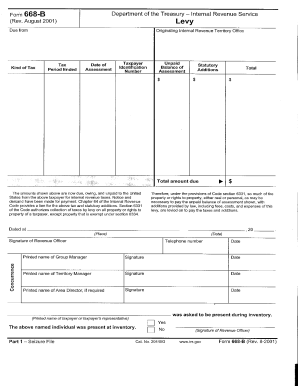

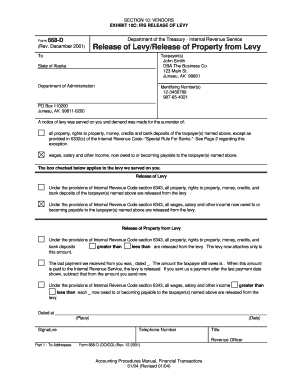

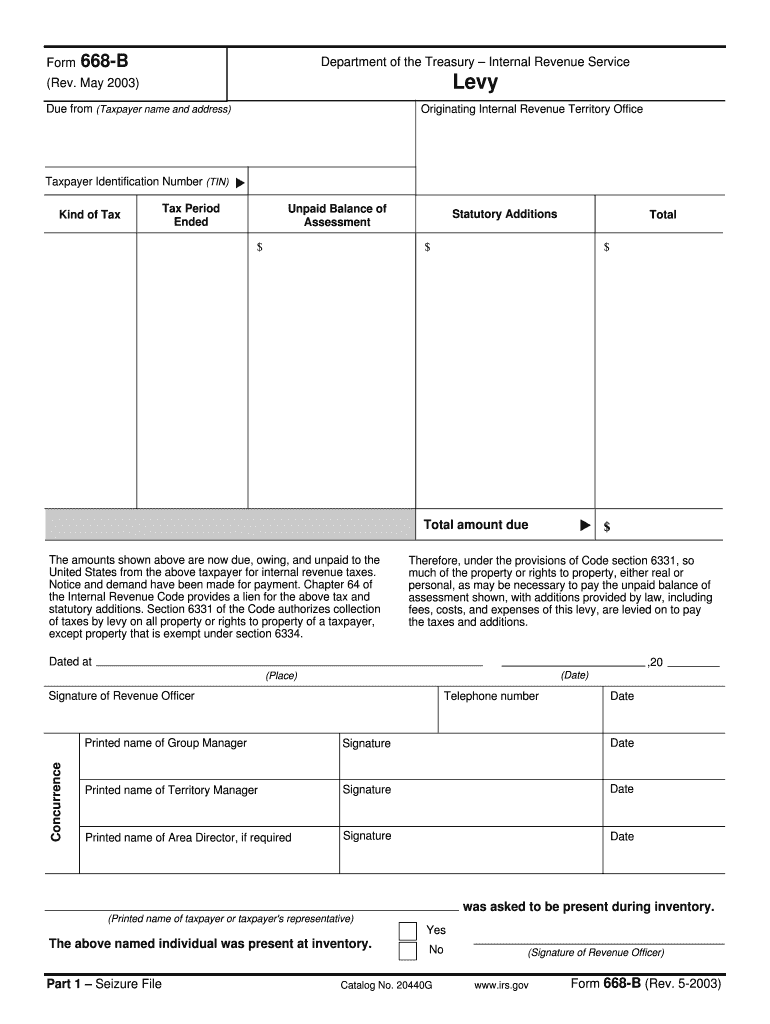

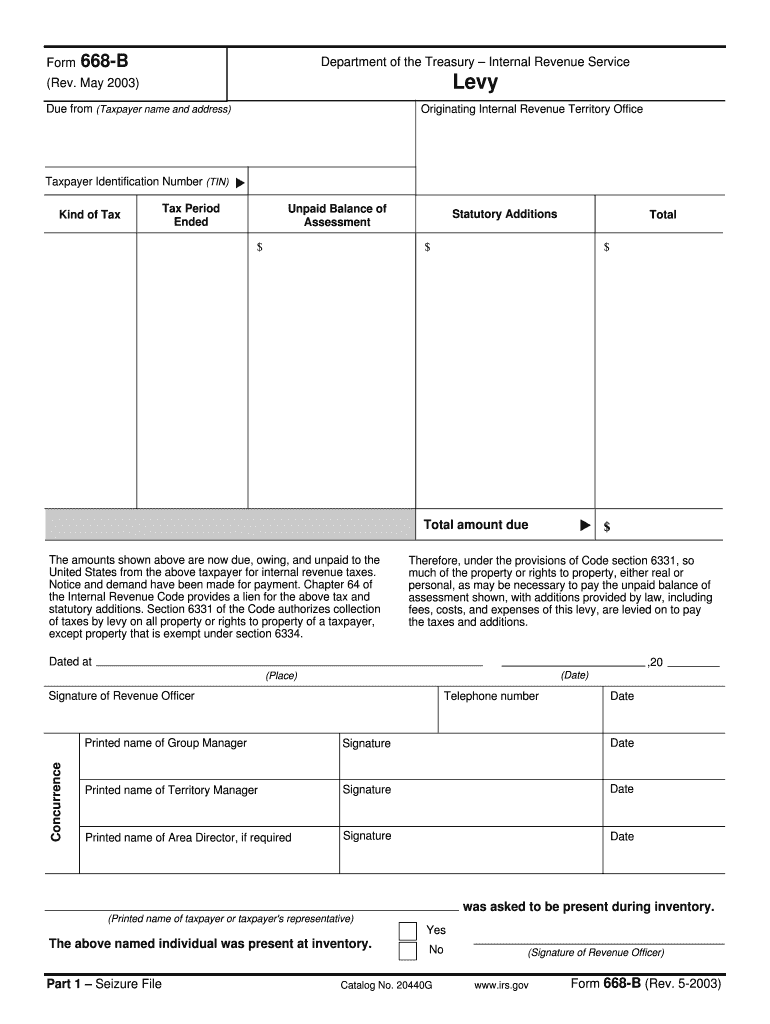

Yes The above named individual was present at inventory. Part 1 Seizure File No Catalog No. 20440G www.irs.gov Form 668-B Rev. 5-2003 Applicable Sections of the Internal Revenue Code Sec. 6321. Form 668-B Department of the Treasury Internal Revenue Service Levy Rev. May 2003 Due from Taxpayer name and address Originating Internal Revenue Territory Office Taxpayer Identification Number TIN Kind of Tax Tax Period Ended Unpaid Balance of Assessment Statutory Additions Total The amounts shown...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 668-B

Edit your IRS 668-B form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 668-B form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 668-B online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IRS 668-B. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 668-B Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 668-B

How to fill out IRS 668-B

01

Obtain the IRS Form 668-B from the IRS website or your tax professional.

02

Review the instructions included with the form to understand the purpose and requirements.

03

In Section 1, provide the taxpayer's name, address, and identification number.

04

In Section 2, indicate the type of tax and the tax period for which the form is being submitted.

05

In Section 3, provide details about any assets you wish to provide for the payment or settlement of the tax obligation.

06

Sign and date the form in the appropriate section.

07

Keep a copy of the completed form for your records.

08

Submit the form as instructed, either by mail or electronically, to the appropriate IRS office.

Who needs IRS 668-B?

01

Individuals or businesses who have disputes with the IRS regarding tax liabilities.

02

Taxpayers who are seeking to negotiate a payment based on the Offer in Compromise process.

03

Those who have received notice of a tax lien and need to provide financial information to the IRS.

Fill

form

: Try Risk Free

People Also Ask about

How long does it take the IRS to stop a levy?

That hold is in effect for 21 days—a period during which you can act to stop the levy. After the 21 days have passed, unless the levy is reversed, your bank must transfer the funds to the IRS. If the initial bank levy does not satisfy the debt in full, the IRS can go back to your bank for additional monies.

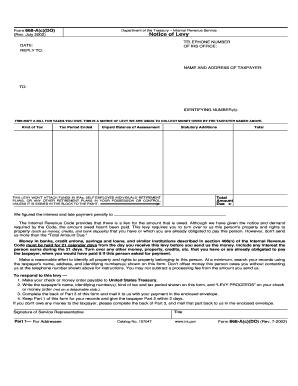

What is a notice of Intent to seize IRS?

This notice is your Notice of Intent to Levy (Internal Revenue Code Section 6331 (d)). If you don't pay the amount due immediately, the IRS can levy your income and bank accounts, as well as seize your property or your right to property including your state income tax refund to pay the amount you owe.

How do I stop an IRS levy quickly?

Contact the IRS immediately to resolve your tax liability and request a levy release. The IRS can also release a levy if it determines that the levy is causing an immediate economic hardship. If the IRS denies your request to release the levy, you may appeal this decision.

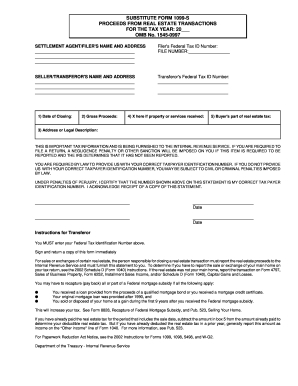

What is a form 668 Y notice of federal tax lien?

This form is filed with local and/or state authorities to alert creditors that the government has an interest in your current and future property and assets.

What is a form 668 for a federal levy?

The IRS generally uses Form 668–W(ICS) or 668-W(C)DO to levy an individual's wages, salary (including fees, bonuses, commissions, and similar items) or other income. Form 668-W(ICS) and/or 668-W(C)(DO) also provides notice of levy on a taxpayer's benefit or retirement income.

How do I respond to IRS levy notice?

If you receive an IRS bill titled Final Notice, Notice of Intent to Levy and Your Right to A Hearing, contact the IRS right away. Call the number on your billing notice, or individuals may contact the IRS at 800-829-1040; businesses may contact us at 800-829-4933.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the IRS 668-B in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your IRS 668-B directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

Can I edit IRS 668-B on an iOS device?

Create, modify, and share IRS 668-B using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

Can I edit IRS 668-B on an Android device?

The pdfFiller app for Android allows you to edit PDF files like IRS 668-B. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is IRS 668-B?

IRS Form 668-B is a Notice of Federal Tax Lien, which is a legal claim against a taxpayer's property when they do not pay their tax debt.

Who is required to file IRS 668-B?

The IRS files Form 668-B when there is a tax liability that has not been paid, and it is typically filed by the IRS itself to inform the public of the lien.

How to fill out IRS 668-B?

IRS 668-B is not filled out by taxpayers; it is prepared and filed by the IRS. The form contains details such as the taxpayer's name, the amount owed, and the date of the lien.

What is the purpose of IRS 668-B?

The purpose of IRS 668-B is to establish a public record of the IRS's claim to a taxpayer's property due to unpaid tax debts, ensuring that creditors are aware of the lien.

What information must be reported on IRS 668-B?

IRS Form 668-B must include details such as the taxpayer's name, address, Social Security number or Employer Identification Number, the date the tax was assessed, and the total amount owed.

Fill out your IRS 668-B online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 668-B is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.